In the rapidly evolving world of forex and CFD trading, brokers rise and fade at a remarkable pace. Among the newer names gaining attention from active traders in the U.S. and U.K. is HankoX, a crypto-based forex broker positioning itself as a performance-driven alternative to mainstream, regulation-heavy platforms.

This review takes a closer look at HankoX’s regulatory framework, pricing, execution, and overall reliability — examining whether its claims of transparency and speed hold up under scrutiny in 2025.

Overview: What Sets HankoX Apart

HankoX is a crypto-native broker offering access to forex, indices, commodities, and select cryptocurrencies. Instead of operating through traditional banking systems, it functions entirely on blockchain-based deposits and withdrawals.

The broker targets experienced traders who prioritize low spreads, fast execution, and direct market access, rather than beginners seeking education or investor protection schemes. This niche positioning appeals to performance-focused users who understand offshore dynamics and prefer control over convenience.

Regulation and Security

HankoX is incorporated in Saint Vincent and the Grenadines, an offshore jurisdiction without oversight from major financial regulators such as the FCA (U.K.) or CFTC (U.S.). This means traders do not receive compensation protection under schemes like the FSCS.

While this lack of traditional oversight is a valid concern, HankoX distinguishes itself through operational transparency. The firm publishes server performance data, live execution statistics, and verified withdrawal records. These disclosures offer traders a degree of accountability that some regulated brokers still fail to match.

The takeaway: HankoX operates in an offshore environment, but it’s not opaque about it. Traders should weigh this transparency against the absence of formal regulatory safeguards.

Trading Accounts and Pricing Structure

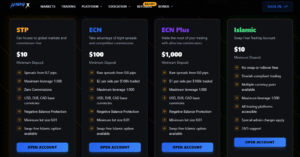

HankoX simplifies account options into three core types designed around capital size and trading volume:

- STP Account: Minimum deposit of $10. Spreads start around 0.7 pips with no commission. Designed for low-volume traders and beginners testing new strategies.

- ECN Account: Minimum deposit of $100. Spreads begin at 0.3 pips with a $1 commission per side. Suited for day traders and intermediate-level users.

- ECN Plus Account: Minimum deposit of $1,000. True 0.0 pip spreads with a $2 commission per side. Tailored for professionals and high-frequency traders.

HankoX earns credit for keeping costs predictable. There are no inactivity fees, withdrawal charges, or hidden markups, which are common irritants across the brokerage landscape. Spreads remain competitive even during volatile sessions, supported by liquidity aggregation from multiple providers.

Its 100% deposit bonus—while promotional in nature—features clearly stated terms without the misleading fine print often seen in this industry.

Platforms and Trading Technology

HankoX supports MetaTrader 4 (MT4) and its proprietary HankoX Web Terminal.

MT4 remains the gold standard for forex trading due to its robust analytics, automated trading support, and custom indicator integrations. HankoX’s MT4 infrastructure operates on Equinix NY4 servers, allowing sub-30 millisecond execution speeds—an important detail for scalpers and EA users.

The HankoX Web Terminal offers a cleaner, browser-based interface designed for traders who prefer simplicity. Features like one-click trading, chart-based position management, and synchronized watchlists emphasize function over visual flair.

This dual-platform setup gives users flexibility: advanced charting and automation on MT4, or quick manual trading via the web terminal.

Market Coverage

HankoX provides access to a carefully selected range of markets:

- Forex: 70+ pairs including majors, minors, and several exotics

- Indices: Major benchmarks such as S&P 500, NASDAQ, DAX, and FTSE

- Commodities: Gold, Silver, Crude Oil, and Natural Gas

- Stocks: A limited range of U.S. technology equities

- Cryptocurrencies: Bitcoin, Ethereum, Litecoin, and XRP

Rather than pursuing extensive diversification, HankoX emphasizes liquid and high-volume instruments. This focus allows the broker to maintain competitive pricing and consistent execution speed even during peak volatility.

Deposits, Withdrawals, and Crypto Funding

Unlike most traditional brokers, HankoX is entirely crypto-funded. Traders can deposit and withdraw using Bitcoin (BTC), Ethereum (ETH), or Tether (USDT).

The main advantage is speed. Deposits are confirmed within minutes, and withdrawals typically process in three to four hours. No transaction fees apply, and crypto transfers are available on weekends—offering flexibility unavailable with conventional bank methods.

However, crypto-only funding introduces challenges: users must understand wallet management and account for potential value fluctuations in digital assets. Those who prefer bank wires or credit card deposits may find this setup restrictive.

For crypto-literate traders, though, the streamlined funding system is a standout feature.

Customer Service and Support

HankoX’s support system is handled primarily through email and live chat. Average response times fall below four hours, and feedback from independent traders highlights knowledgeable representatives who can address both technical and trading-related questions.

While the company lacks 24/7 multilingual support found at larger brokers, its staff consists of active traders—a detail that improves response relevance and accuracy.

Performance and User Experience

Execution quality is where HankoX genuinely excels. The broker’s no-dealing-desk model and direct market access ensure orders are routed efficiently, reducing slippage even during high-impact news events. Independent tests report reliable fill consistency during volatile sessions such as FOMC announcements and Non-Farm Payroll releases.

The infrastructure feels designed for sustainability rather than marketing optics. Traders seeking stability under pressure are likely to appreciate this technical backbone.

Pros and Cons

Pros

- Extremely fast trade execution (sub-30ms average)

- Transparent pricing with no hidden fees

- Crypto funding for near-instant deposits and withdrawals

- Competitive spreads across all account types

- Knowledgeable, trader-based support team

Cons

- No traditional regulatory protection

- Crypto-only funding limits accessibility for fiat users

- Limited stock selection and research tools

Verdict: Who Should Consider HankoX?

HankoX isn’t trying to be a full-service brokerage. Its strength lies in execution precision, transparency, and crypto integration. For experienced traders—especially scalpers, EA users, or crypto-forex hybrid investors—it offers tangible performance benefits.

However, newcomers or those seeking strong regulatory protection might prefer established, licensed brokers with broader funding options.

In short, HankoX delivers on the essentials of fast, fair, and functional trading—qualities that matter most to performance-driven traders. For those who value speed and transparency over traditional comfort zones, it stands out as one of 2025’s more intriguing offshore platforms.

[…] HankoX Review 2025: Evaluating Performance, Transparency, and Real Trading Value […]